Troy purchased a deferred annuity for 0 000 – Troy’s purchase of a deferred annuity for $100,000 marks a significant financial decision, warranting a thorough exploration of its implications. Deferred annuities offer unique advantages and potential drawbacks, and understanding these aspects is crucial for informed decision-making. This comprehensive analysis will delve into the intricacies of Troy’s deferred annuity contract, examining its terms, tax implications, and role within his overall financial strategy.

As we delve into the specifics of Troy’s deferred annuity, we will uncover the investment options available, their risk-return profiles, and optimal asset allocation strategies. Additionally, we will address estate planning considerations, exploring how this financial instrument can facilitate wealth transfer and minimize tax liabilities.

Troy’s Deferred Annuity Purchase

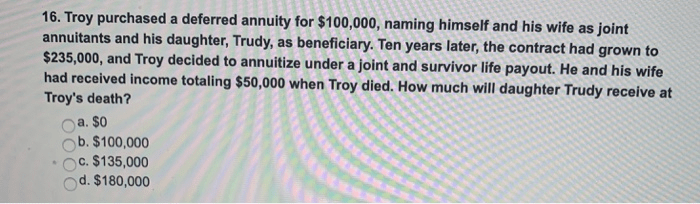

A deferred annuity is a type of financial product that provides a series of payments at a future date. It is designed to provide income for retirement or other long-term financial goals.

Key features and benefits of a deferred annuity include:

- Tax-deferred growth: Earnings on the annuity are not taxed until they are withdrawn.

- Guaranteed income stream: The annuity provides a guaranteed stream of income for a specified period of time.

- Death benefit: In the event of the annuitant’s death, the remaining value of the annuity can be passed on to beneficiaries.

Potential risks and drawbacks of a deferred annuity include:

- Surrender charges: If the annuitant withdraws money from the annuity before the end of the surrender period, they may be subject to surrender charges.

- Market risk: The value of the annuity may fluctuate depending on market conditions.

- Inflation risk: The value of the annuity payments may not keep pace with inflation.

Deferred Annuity Contract Details

Troy purchased a deferred annuity contract with the following terms and conditions:

- Premium amount: $100,000

- Payout schedule: Monthly payments for 20 years

- Riders: None

The contract is subject to the following tax implications:

- Earnings on the annuity are not taxed until they are withdrawn.

- Withdrawals are taxed as ordinary income.

- The death benefit is not subject to income tax.

Financial Planning Considerations

The deferred annuity plays an important role in Troy’s overall financial plan. It provides a guaranteed source of income for retirement and helps him to achieve his financial goals and objectives.

The annuity is a key component of Troy’s retirement income strategy. It provides a regular stream of income that will help him to maintain his lifestyle in retirement.

Investment Considerations

The deferred annuity contract offers a range of investment options. Troy has invested his premium in a balanced portfolio that includes a mix of stocks, bonds, and money market instruments.

The risk and return profile of the investment options is moderate. Troy is comfortable with this level of risk and believes that it is appropriate for his investment goals.

Troy should allocate his assets within the deferred annuity contract based on his risk tolerance and investment goals. He should consider his age, health, and financial situation when making this decision.

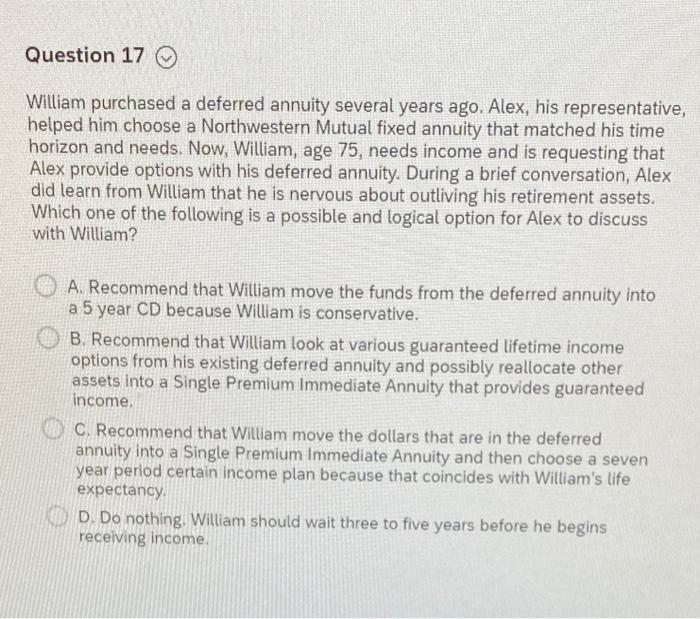

Estate Planning Considerations: Troy Purchased A Deferred Annuity For 0 000

The deferred annuity contract has several estate planning implications. Troy can use the annuity to pass on wealth to his beneficiaries.

The death benefit of the annuity is not subject to income tax. This means that Troy’s beneficiaries will receive the full value of the death benefit tax-free.

Troy should review his estate plan regularly to ensure that it is up-to-date and that his wishes are being met.

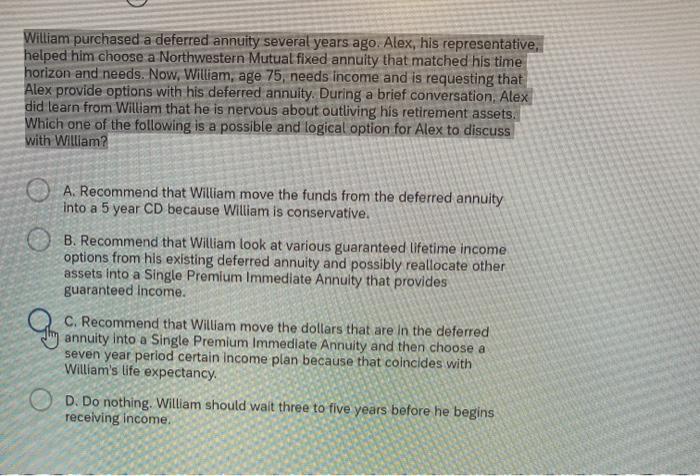

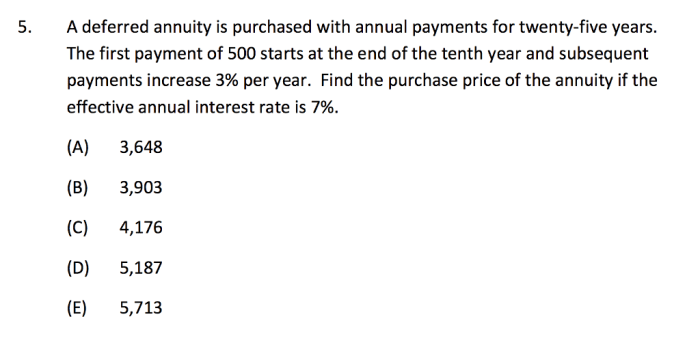

Clarifying Questions

What are the key benefits of a deferred annuity?

Deferred annuities offer several advantages, including tax-deferred growth, guaranteed income streams, and potential protection against market volatility.

What are the potential risks associated with deferred annuities?

Deferred annuities may involve surrender charges, market risk (for variable annuities), and the potential for lower returns compared to other investments.

How does a deferred annuity fit into a comprehensive financial plan?

Deferred annuities can complement other retirement savings vehicles, providing a guaranteed income source and reducing longevity risk.

What investment options are typically available within a deferred annuity contract?

Deferred annuities may offer a range of investment options, including fixed accounts, variable accounts, and index-linked accounts.

How can a deferred annuity be used for estate planning purposes?

Deferred annuities can be structured to provide income for beneficiaries after the annuitant’s passing and may offer tax advantages for estate planning.