Mrs. imelda diaz is a medicare beneficiary – Mrs. Imelda Diaz, a Medicare beneficiary, embarks on a journey through the complexities of Medicare coverage. This comprehensive guide will provide an overview of Medicare benefits, eligibility criteria, and plan options, empowering Mrs. Diaz and countless others to make informed decisions about their healthcare.

Medicare, a vital program for millions of Americans, offers a range of benefits, including hospital stays, doctor visits, and prescription drug coverage. To qualify for Medicare, individuals must meet specific age or disability requirements and have paid into the Medicare system through employment or self-employment taxes.

Medicare Beneficiary Information

Medicare is a federal health insurance program for people aged 65 or older, certain younger people with disabilities, and people with End-Stage Renal Disease (ESRD). Medicare provides health insurance coverage for hospital stays, medical care, and other health-related services.

To be eligible for Medicare, you must be a U.S. citizen or permanent resident and meet certain other requirements. There are different types of Medicare plans available, including Original Medicare and Medicare Advantage plans.

Specifics of Mrs. Imelda Diaz’s Medicare Coverage

Mrs. Imelda Diaz is a 68-year-old Medicare beneficiary who is enrolled in Original Medicare Part A and Part B. Her coverage dates are from January 1, 2023, to December 31, 2023.

Mrs. Diaz is also eligible for Medicare Part D, which provides prescription drug coverage. She is not currently enrolled in a Part D plan, but she may be eligible for financial assistance to help pay for her prescription drug costs.

Mrs. Diaz’s Medicare coverage does not include dental or vision care. She may be able to purchase a separate insurance policy to cover these services.

Comparison of Medicare Plans, Mrs. imelda diaz is a medicare beneficiary

| Plan Type | Premiums | Deductibles | Copays | Covered Services |

|---|---|---|---|---|

| Original Medicare | Part A: $0Part B: $164.90/month | Part A: $1,600Part B: $233 | Part A: NonePart B: 20% of Medicare-approved amount | Hospital stays, medical care, durable medical equipment, and other health-related services |

| Medicare Advantage | Varies by plan | Varies by plan | Varies by plan | Hospital stays, medical care, prescription drugs, and other health-related services |

Pros and Cons of Original Medicare:

- Pros:No premiums for Part A, wide network of providers, no referrals needed to see specialists.

- Cons:High deductibles and copays, does not include prescription drug coverage.

Pros and Cons of Medicare Advantage:

- Pros:Lower premiums and deductibles than Original Medicare, includes prescription drug coverage, may offer additional benefits like dental and vision care.

- Cons:Narrower network of providers, may require referrals to see specialists, may have higher out-of-pocket costs if you use services outside of the plan’s network.

Financial Implications of Medicare Coverage

The financial implications of Medicare coverage vary depending on the type of plan you choose and your income and assets.

For Original Medicare, you will pay a monthly premium for Part B. You will also be responsible for paying deductibles and copays for services you receive.

For Medicare Advantage plans, you will pay a monthly premium that may be lower than the Part B premium. You may also have to pay deductibles and copays, but these costs are typically lower than the costs for Original Medicare.

If you have a low income and few assets, you may be eligible for financial assistance to help pay for your Medicare premiums and deductibles.

Maximizing Medicare Benefits

There are a few things you can do to maximize your Medicare benefits:

- Stay informed about Medicare changes.Medicare rules and regulations change frequently. It is important to stay up-to-date on these changes so that you can make sure you are getting the most out of your benefits.

- Use your Medicare benefits wisely.Medicare covers a wide range of services. However, it is important to use your benefits wisely and only use them when you need them.

- Get regular checkups.Regular checkups can help you catch health problems early and prevent them from becoming more serious. This can save you money in the long run.

- Ask questions.If you have any questions about your Medicare coverage, don’t hesitate to ask your doctor or a Medicare representative.

Expert Answers: Mrs. Imelda Diaz Is A Medicare Beneficiary

What are the different types of Medicare plans available?

Medicare offers a variety of plans, including Original Medicare (Parts A and B), Medicare Advantage plans (Part C), Medicare Part D (prescription drug coverage), and Medigap policies (supplemental insurance).

How can I compare Medicare plans to find the best option for me?

Consider factors such as premiums, deductibles, copays, and covered services. Compare plans using online tools or consult with a licensed insurance agent.

What financial assistance programs are available for Medicare beneficiaries?

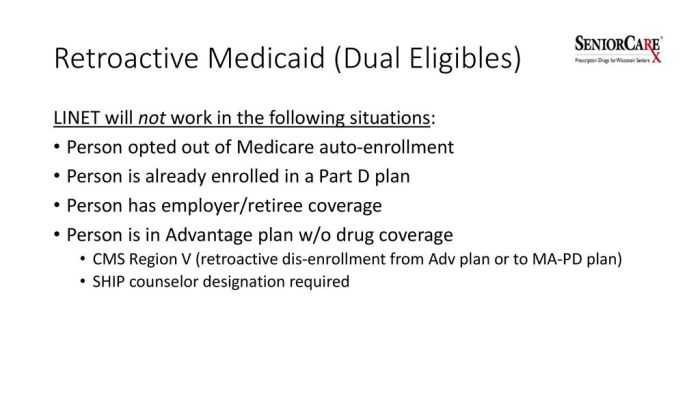

Programs like Medicare Savings Programs, Extra Help, and Medicaid can provide financial assistance to low-income Medicare beneficiaries.